Financial Accounting Vs Managerial Accounting: Key Differences and Examples

Budgeting is planning and controlling financial resources to outline the expected revenues, expenses, and capital investments. It compares the actual financial outcomes with budgeted figures to analyze the differences and understand their causes. A managerial accountant’s job is to identify this issue and help Monsson gain a competitive advantage. It can bring down the cost of production through alternative suppliers and offer the same dress for $10. Then, revenue generation and competition will hinge on brand image and customer loyalty alone.

What is the approximate value of your cash savings and other investments?

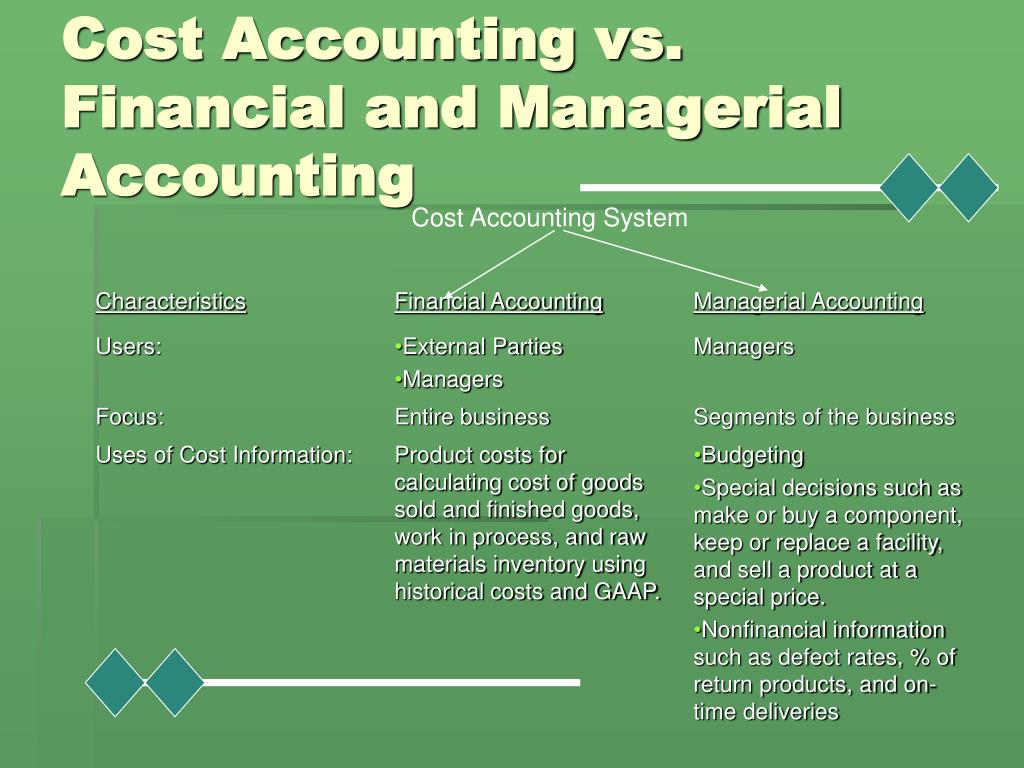

Though the results of managerial accounting can be applied to the organization as a whole, they are most often concerned with finer details, such as production efficiency, customer satisfaction, and marketing success. On the surface, managerial accounting vs. financial accounting may not seem like it’s relevant to your business. But pop the hood, so to speak, and you’ll quickly see how the two types of accounting are different — and why both are extremely important for your business. Managerial accounting dives deeply into the nature of costs to differentiate between the different classes, such as fixed variable direct and indirect. This detailed cost analysis is necessary for internal decision-making, especially for pricing strategies, budgeting, and identifying areas where cost can be reduced without compromising quality.

Strategic Decision Making

Located in Waltham, Massachusetts, just west of Boston, Bentley University specializes in delivering business education. No, all of our programs are 100 percent online, and available to participants regardless of their location. Finance refers to the ways in which a person or organization generates and uses capital—in other words, how a given party manages their money.

- Financial accounting is responsible for making detailed reports of a company’s financial statements and communicating financial information to company leaders and shareholders.

- Performance measures such as return on equity, debt to equity, and return on invested capital help management identify key information about borrowed capital, prior to relaying these statistics to outside sources.

- Managerial accounting is not intended for external users and can be modified according to the company’s processes.

- Financial accounting, on the other hand, requires an eye for detail and an ability to adhere to strict guidelines.

- To understand the difference between finance and accounting, you need to know what each term means.

No Standards vs. High Standards

Financial accounting has some internal uses as well, but its focus is on informing those outside of a company. The final accounts or financial statements produced through financial accounting are designed to disclose the firm’s business performance and financial health. The main objective of financial accounting is to ascertain the results of business operations of the business, in terms of profit or loss for the period. Also, it tends to provide information relating to the company’s financial standing on the last day of the accounting period.

Another helpful certification for financial accountants is the Certified Internal Auditor designation awarded by the Institute of Internal Auditors. The U.S. Bureau of Labor Statistics (BLS) states that employers prefer accountant candidates who have a master’s degree in accounting or business administration with a concentration in accounting. For example, both require individuals to monitor financial records and present their findings based on insights from the data. Both also require a thorough knowledge of accounting principles and management theory, as well as a background in the company’s business lines. The accrual method of accounting, which is followed by most organizations, records transactions as they are agreed upon, as opposed to when they are completed. It allows for transactions to be made with credit or deferred payments, and operates under the idea that revenues and costs will smooth out over time to more accurately depict economic reality.

On the one hand, financial accounting aims to provide financial statements, including measuring a company’s performance to assess its financial health. Conversely, managerial accounting aims to provide financial information so managers can make decisions aligned with their business strategies. Though there are many differences between the two, utilizing them can ensure that a company gets accurate financial statements and forecasts for a more productive and profitable future. Bentley offers nearly a dozen different degrees in the business fields, from joint technology and business programs to traditional majors in accounting, finance, management, and more.

This field of accounting also utilizes previous period information to calculate and project future financial information. This may include the use of historical pricing, sales volumes, geographical locations, customer tendencies, or financial information. sample business budget template for income and expenses The information contained in financial accounting reports has a tendency to be compiled, condensed, and generalized for a number of reasons. At the same time, that information is becoming more open, and it is also becoming less revealing.

On the other hand, the documents generated by financial accounting are subject to stringent regulations, particularly the income statement, balance sheet, and cash flow statement. When developing their projections, investors and creditors frequently consult financial statements as a resource. Reports produced by financial accounting (e.g., financial statements and investor reports) are largely distributed (or at least available) externally to people outside your organization. No business can function effectively for long without following industry standards and guidelines. This means your business will always meet accounting standards on how financial transactions are supposed to be recorded and reported to external authorities.